Renting out a house can be a lucrative method to earn passive income, create wealth, and make the most of an investment property. However, how to rent out your house is a matter of a clear understanding of the financial and legal issues involved. This not only safeguards your rights but also ensures a smooth experience for both the tenant and landlord. Here's a breakdown of the important things to bear in mind prior to renting your property.

1. Understand Local Rental Laws

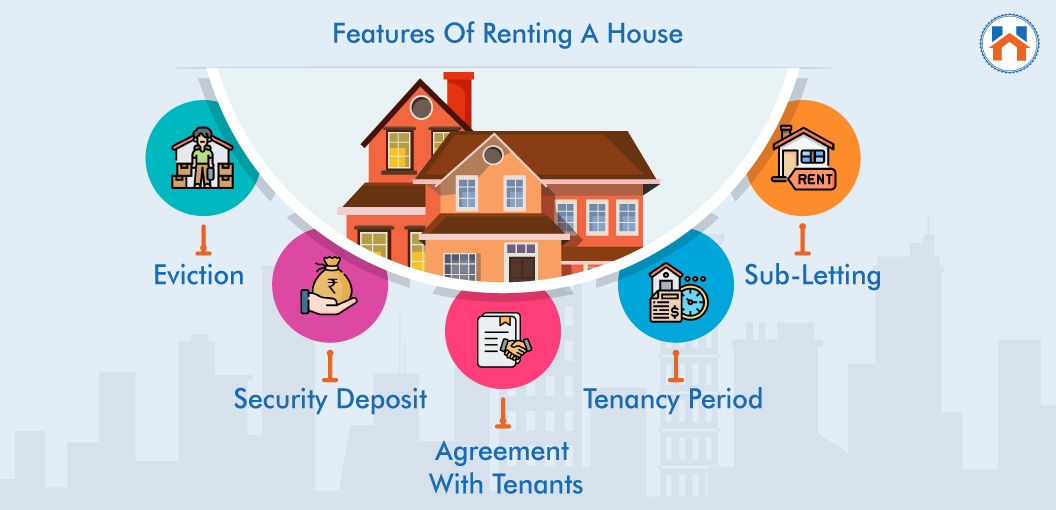

One of the first steps to take when renting your home is educating yourself about the state and local rental laws. The laws govern your obligations as well as the legal rights your tenant. From security deposits to lease contracts to eviction processes Understanding the rules will help you avoid legal battles that can be costly. Being compliant increases trust and ensures you operate your rental property ethically and efficiently.

2. Draft a Comprehensive Lease Agreement

A properly written lease agreement is the backbone of any rental agreement. It should clearly define the tenancy's terms which include rent amounts, payment deadlines, duration of the lease, maintenance responsibilities, and rules regarding pets and alterations. This document is an legal contract that protects the parties from misunderstandings. The time spent in drafting the lease agreement in detail provides clarity and sets expectations upfront.

3. Screen Tenants Thoroughly

Finding the right tenant is essential to have a successful rental experience. Perform background screenings, check employment, and check the history of your rental to ensure trust as well as financial security. Tenants who are responsible pay their rent promptly and maintain your property, which reduces the cost of repairs and turnover. A thorough screening process is an investment in peace of mind and long-term profit.

4. Insurance Coverage

Protecting your property with appropriate insurance is essential. The insurance for landlords typically protects against property damage, liability, and loss in rental revenue. If you do not have adequate insurance, sudden circumstances such as natural disasters or injuries suffered by tenants can cause a significant financial loss. Insuring your rental business with insurance will ensure that you are protected from these dangers, and adds an important layer of protection for your rental business.

5. Budget for Maintenance and Repairs

Owning a rental property involves regular expenses that go beyond the mortgage. The idea of putting aside money for routine maintenance and unforeseen repairs keeps your home appealing and functional, while keeping its value. Regular maintenance reduces the risk of expensive emergencies and increases tenant satisfaction, encouraging longer leases.

6. Understand Tax Implications

The rental income you earn is taxable but many expenses related to managing your property can be deducted. Being aware of the costs that qualify- such as mortgage interest tax, the cost of property tax, premiums for insurance, and repair expenses -- can significantly reduce your tax liability. Consulting with a tax professional ensures you maximize the benefits of tax while adhering to tax regulations.

Benefits and Importance

The act of renting out a home does not only provide steady income, but it can also help diversify your investment portfolio. When handled correctly it can build equity and is an avenue to financial independence. Making sure you are taking care of financial and legal issues minimizes risks and creates a positive rental experience that benefits both landlord and the tenant. With the right planning renting your house can be an enjoyable venture that increases your wealth while ensuring your financial future.